After the US Federal Reserve announced a 25 bps rate cut on Wednesday, the Bitcoin price came crashing under the $100K level to trigger the broader crypto market crash. The selling pressure was a reaction to the Fed’s future monetary policy guidance for 2025 and coming years.

Along with Bitcoin, altcoins also faced strong pullback correcting to the tune of 10% and more. Top altcoins such as Ethereum (ETH), Dogecoin (DOGE), XRP, Solana (SOL), and others corrected 5-10% triggering more than $860 million in liquidations.

Crypto Market Crash Saw Over $860 Million in Liquidation

Bitcoin Price Drops Following Fed’s Hawkish Stance for 2025

On Wednesday, the US Federal Reserve announced its third rate cut of 25 bps on the expected lines with Jerome Powell setting up a hawkish undertone for 2025. Powell stated that the US central bank will proceed with only 2 rate cuts in 2025, against the anticipated 4 rate cuts.

This was enough to send the Bitcoin price crashing under the crucial support of $100K levels. Thus, this recent correction has wiped out all the weekly gains for BTC, after hitting an all-time high above $108K earlier this week.

Jerome Powell stated that the Fed remains committed to bringing inflation under the desired 2% target. The Fed chair also stated that achieving the 2% inflation target could take 1-2 years further adding to the hawkish tone.

BTC Performs Better Than S&P 500 Despite Crypto Market Crash

Blockchain analytics platform Santiment reported that BTC had shown a greater relative strength in comparison to the drop in the S&P 500. “This can actually be interpreted as a sign of strength once the dust settles over the next 24-48 hours,” noted Santiment.

Source: Santiment

Also, a majority of the US Bitcoin ETFs registered net outflows including Bitwise’s BITB, Invesco’s BTCO, Ark Invest’s ARKB, and Grayscale’s GBTC amid today’s crypto market crash. However, BlackRock’s IBIT saw a strong $356 million in inflows cancelling the overall negative impact. Despite the current turbulence, crypto market analysts continue to remain positive.

Popular economist Alex Kruger wrote:

“Next week is Xmas, which may change things. In my book BTC bouncing off 98 and SOL off 195 would be ideal. And then, up only into inauguration. Euphoria and leverage have been largely flushed out from crypto already, which should minimize the downside. Bigger picture unchanged IMO.”

Bank of Japan Keeps Interest Rates Unchanged

The Bank of Japan maintained its short-term policy rate at -0.1% on Thursday, choosing to monitor wage growth and inflation trends before making any adjustments. The widely expected decision underscores a cautious approach to monetary policy.

In response, the yen weakened further, slipping past the critical 155 mark against the dollar, as the central bank refrained from raising borrowing costs.

As a result, BTC price bounced back from the lows of under $100K and is currently trading at $101,020 as of press time. As per Coinglass data, the 24-hour BTC liquidations have soared to $148 million with $114 million worth of long liquidations.

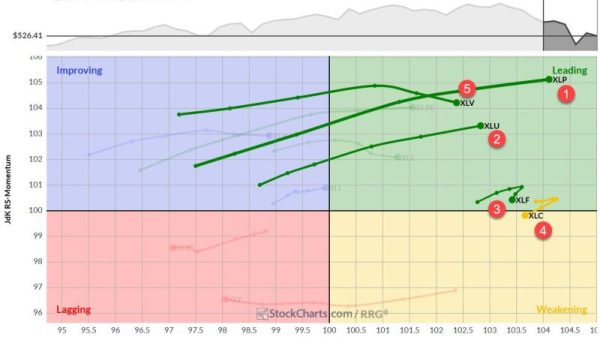

Altcoins Register Steeper Fall Than Bitcoin

Along with the price of Bitcoin down today, altcoins faced an even greater fall with ETH, DOGE, XRP, and SOL all plunging between 5-10%. Other altcoins saw an even greater correction of between 10-20% in today’s crypto market crash.

Crypto market data provider Santiment reported significant declines across several major altcoins over the past 24 hours. Avalanche (AVAX), Chainlink (LINK), and Litecoin (LTC) each dropped 16%, while meme coin Pepe (PEPE) fell 17%, reflecting widespread market turbulence.

Santiment noted that while the pullback has been sharp, it could present an opportunity for dip buyers. “If this was indeed an overreaction, there is a reasonable chance that the projects with the biggest drops will offer the most attractive buying opportunities,” the report suggested.

Well, this total crypto market volatility has led to total crypto market liquidations soaring to $860 million, per the Coinglass data. The 24-hour long liquidations have surged to $684.93M million while $200 million in short liquidations amid the crypto market crash.

As CoinGape reported, altcoin season index has come crashing further to 55 leading to speculation of the end of the altcoin season. As per the Blockchain Center data, the altcoin season index is currently at 55, testing the crucial support of 50. Crypto market analysts expect a bounce back from here.

Source: Blockchain Center

ETH Price Bounces Back from Crucial Support Levels

The ETH price crashed nearly 6% but bounced back from the crucial support of $3,550. Crypto analyst IncomeSharks highlighted Ethereum’s resilience amid recent market fluctuations, noting that the Supertrend indicator remains intact and bullish.

“Ethereum ($ETH) hasn’t broken its Supertrend, maintaining a bullish outlook,” the analyst stated. “Currently, prices are holding at support levels, and in such conditions, shorting is not advisable.”

Source: IncomeSharks

XRP Price Rally to Continue Amid Crypto Market Crash?

Amid the broader crypto market crash, the XRP price has dropped 6.2% all the way to $2.25. Crypto analyst IncomeSharks has highlighted a critical juncture for XRP as it tests its Supertrend support.

“If bulls can defend this Supertrend level and establish a bullish consolidation pattern, it could provide a strong rationale for re-entry,” the analyst noted. Moreover, another analysis predicts XRP price potential rally to $6.

Source: Incomesharks

The post Crypto Market Crash: Bitcoin, ETH, XRP, DOGE, SOL Trigger $860M In Liquidations appeared first on CoinGape.