Solana price has experienced a notable decrease in the past 24 hours, reflecting the broader crypto market cues. This drop comes after SOL hit a three-month high. However, the recent Federal Reserve rate cut has triggered a market-wide sell off that could knock this Ethereum-killer lower. This article explores the idea of Solana price crashing below the $200-mark.

Will Solana Price Dip Below $200?

Solana price movements are under scrutiny after the U.S. Federal Reserve announced a 25 basis point rate cut on Wednesday. The rate cut, accompanied by projections for future monetary policy in 2025, triggered widespread market reactions.

Bitcoin faced a sharp decline, hovering around the $101,000 mark, which sparked a broader cryptocurrency market sell-off. Solana, which recently reached a peak of $264 earlier this month, has been on a declining trend. SOL price recently hovers in the $200-$220 range. A break below $200 could signal a deeper correction for Solana, raising investor concerns.

Source: X

Is It Time To Buy SOL Dip?

The Solana price recently dipped below $210, raising questions about whether now is the time to buy the dip. Altcoins, including Ethereum, SHIB, and XRP, have faced notable corrections, leading to widespread market sell-offs.

Over the past 24 hours, assets such as Avalanche, Chainlink, and Litecoin have each dropped by 16%. Meanwhile, Pepe price plunged by 17%, reflecting heightened volatility and significant liquidations across the crypto market.

This sharp pullback has sparked speculation about whether the declines are an overreaction. Expert suggest that projects experiencing the largest drops may present lucrative buying opportunities. Solana’s current position has traders eyeing its potential for a rebound.

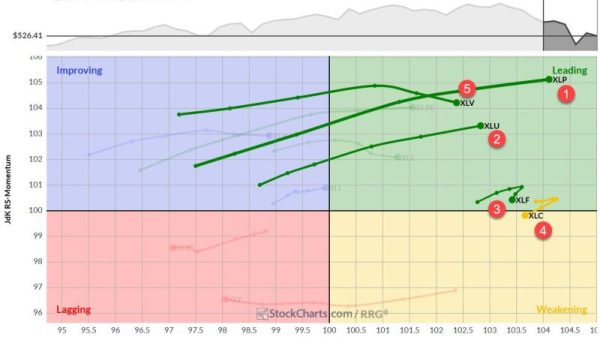

The crypto whales in the whale space show how big players can impact the movements of assets. Santiment recent data reveals Solana price correlated with stablecoin reserves former $5 million holders total balance. This trend is a result of strategic movements in both directions of the accumulation, distribution and hence affects market sentiment.

Source- Santiment

SOL Technical Analysis

According to the latest data, the SOL price right now is $210 which is a -4% decrease over the last 24h (U.S time zone). Relative Strength Index (RSI) has got into the mild bearish territory at 39. The trend remains important for buyers to come in and shift.

Source: TradingView

If the bearish pressure persists, the Solana price prediction could break below the $205 support level. A further dip might push the price toward the critical $200 level, and if the downtrend continues, it could even test the $180 mark.

However, if the bulls regain control, SOL could see a recovery. A strong upward momentum may propel the price toward $263, potentially hitting ATH.

Solana’s price faces a critical juncture amid market uncertainty. While bearish pressure looms, strong fundamentals and whale activity suggest potential recovery opportunities for investors closely monitoring the $200 level.

The post Will Solana Price Dip Below $200 After Federal Reserve Cut? appeared first on CoinGape.