The launch of spot Bitcoin ETFs and spot Ethereum ETFs in the United States this year has stormed the exchange-traded fund (ETF) market with massive inflows. Of the 740 ETFs launched this year, crypto ETFs dominate the top eight spots in terms of inflows. Following Donald Trump’s victory in 2024 US elections, inflows into BTC and Ether ETF have surged significantly in the hope of crypto-friendly policies and the plans of building a strategic Bitcoin reserve.

Bitcoin ETF Dominate ETF Launches in 2024

Nate Geraci, President of the ETF Store, highlighted the growing dominance of crypto-focused exchange-traded funds (ETFs) in 2024. According to Geraci, the top eight ETF launches this year have all been tied to digital assets.

These include four spot Bitcoin ETFs, two spot Ethereum ETFs, and two ETFs tracking MicroStrategy (MSTR). This surge in crypto-related ETFs stands out against the backdrop of nearly 740 total ETF launches in 2024. Thus, it highlights a major shift in the investing landscape as BTC and crypto become more mainstream.

Source: Nate Geraci

As per the above image, BlackRock’s IBIT and ETHA products continue to garner heavy demand among investors. Nate Geraci also noted that there’s a very high demand for crypto ETFs tracking the MSTR stock, which has delivered massive returns in 2024, while recently entering the Nasdaq 100 index.

Strong Inflows Continue for BTC and Ethereum ETFs

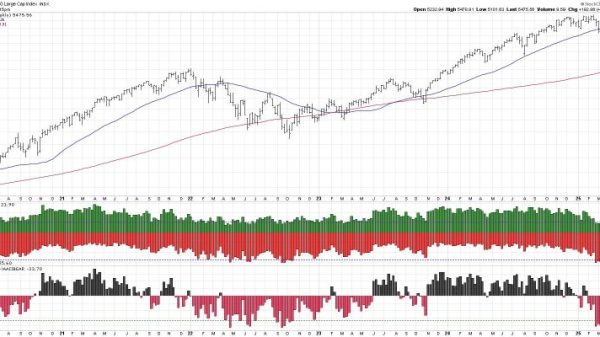

Last week, between December 23 and December 27, spot Bitcoin ETFs experienced a net outflow of $388 million, reflecting some profit-taking and portfolio rebalancing. However, the Fidelity ETF (FBTC) saw a weekly net inflow of $183 million, signaling sustained interest from certain investor segments. The total net asset value (NAV) of Bitcoin spot ETFs now stands at $106.683 billion, per data from SoSo Value.

Source: SoSoValue

On the other hand, Bitcoin price remains under selling pressure dropping under $94,000 levels. Crypto market analyst Ali Martinez has highlighted a potential bullish setup for Bitcoin (BTC) signaling a possible price rebound. However, the analyst emphasized that the recovery is contingent upon BTC maintaining its critical support level at $93,000.

Unlike Bitcoin ETF outflows last week, Crypto analyst Ali Martinez has reported a significant bullish sentiment among Ethereum (ETH) traders on BitMEX. According to Martinez, 78.30% of traders with open futures positions on the platform are betting on an upward price movement for Ethereum. during the same period, with a net addition of $349 million. The BlackRock ETF (ETHA) and Fidelity ETF (FETH) contributed significantly, reporting weekly net inflows of $182 million and $160 million, respectively.

Source: SoSo Value

The Ethereum price has also been under selling pressure and is currently trading at $3,400. However, on-chain data suggests a bullish action for Ethereum moving ahead. Crypto analyst Ali Martinez has reported a significant bullish sentiment among Ethereum (ETH) traders on BitMEX. According to Martinez, 78.30% of traders with open futures positions on the platform are betting on an upward price movement for Ethereum.

The post Bitcoin ETF and Ethereum ETF Dominate Across 740 ETF Launches in 2024 appeared first on CoinGape.