The U.S. Securities and Exchange Commission (SEC) has acknowledged Grayscale’s application to list a Hedera (HBAR) ETF on the Nasdaq stock exchange. This step marks the beginning of a 21-day public comment period, after which the SEC will decide whether to approve, disapprove, or proceed with further review.

The decision could have broad implications for the cryptocurrency investment landscape, especially for those interested in gaining exposure to HBAR without directly owning the asset.

US SEC Acknowledges Grayscale’s Hedera ETF Filing

Grayscale’s proposed ETF will track the price of Hedera’s native token, HBAR. The ETF filing was submitted by Nasdaq, which has requested SEC approval to list the Grayscale Hedera Trust. If approved, the shares of this trust would trade under commodity-based trust share rules.

BNY Mellon Asset Servicing is expected to act as the administrator and transfer agent for the trust. Other key players involved include Coinbase Custody Trust Company, which will serve as the custodian, and CSC Delaware Trust Company as the trustee.

Grayscale’s filing comes after the SEC approved similar applications for Bitcoin and Ethereum spot ETFs. Nasdaq believes its surveillance-sharing agreement with Coinbase Derivatives, through ISG membership, offers sufficient investor protection. This agreement has been critical in facilitating past ETF approvals, and Nasdaq has emphasized its role in ensuring market integrity.

Public Comment Period and the SEC’s Decision-Making Process

Upon acknowledging the filing, the SEC has opened a 21-day public comment period, during which market participants and the general public can submit feedback. This step is part of the US SEC’s standard procedure for reviewing ETF filings. After this comment period, the regulator will make its decision to either approve or disapprove the application, or it may initiate further proceedings.

While SEC acknowledgment is an important milestone, it does not guarantee approval. The SEC has previously expressed concerns about the risks associated with cryptocurrency products.

However, with the recent approval of Bitcoin and Ethereum spot ETFs, the regulator’s stance on crypto investment products could be shifting. Grayscale is not the only firm pursuing cryptocurrency ETFs. Canary Capital also filed a similar application for a Hedera ETF earlier this year. Additionally, Grayscale has been aggressive in expanding its digital asset portfolio, seeking approval for ETFs based on assets like Polkadot (DOT), XRP, Dogecoin (DOGE), Solana (SOL), and Cardano (ADA).

Will Hedera Price Surge Amid HBAR ETF Approval?

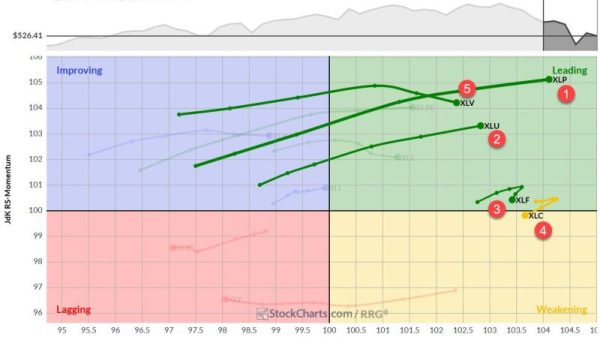

Hedera price has recently faced significant fluctuations. It experienced a sharp rise toward the $0.25 level, which marked a bullish trend. However, the price has since declined and is now testing support levels around $0.18 to $0.20. If these support levels hold, there could be a potential reversal or consolidation in the coming weeks.

Subsequently, the Moving Average Convergence Divergence (MACD) shows that the blue line is above the orange signal line, suggesting bullish momentum. However, the histogram is shrinking, indicating a weakening of this momentum.

In addition, the Relative Strength Index (RSI) currently stands at 46.60, which signals neutral territory, with no clear overbought or oversold condition. A recent dip toward 41.22 shows slight bearish pressure, but it has not yet reached the oversold zone.

The post US SEC Acknowledges Grayscale’s Hedera ETF Filing, What Next? appeared first on CoinGape.