Shiba Inu (SHIB) price has gained attention recently, but it is struggling to maintain momentum. Currently, SHIB is hovering near the $0.000011 support level, showing difficulty in recovering. Over the past week, the coin has dropped by 10%, following the general downturn in the broader crypto market. With this in mind, here are the top 5 risks that could further impact Shiba Inu’s price movement.

Top 5 Factors That Could Affect Shiba Inu Price

The Shiba Inu price continues to feel the impact of various market factors, with a direct correlation to the performance of its competitor, Dogecoin (DOGE).

As DOGE struggles, losing 17% in value over the past week, Shiba Inu also experiences a downturn. This negative trend highlights the close relationship between these two meme coins in the broader crypto market.

The meme coin sector, in general, is witnessing a decline. With a market capitalization of $2.63 trillion, the sector is down by 1.64%. As the second-largest meme-based coin after Dogecoin, Shiba Inu has not been immune to this dip.

Furthermore, new meme coins like PENGU, TRUMP, FARTCOIN, and Ai16z are gaining attention, which threatens Shiba Inu’s position in the market.

Another factor influencing Shiba Inu’s price is the price of BTC price, which is currently facing uncertainty. Analysts predict that BTC could fall to $70K or even $65K, causing a ripple effect across the cryptocurrency market.

Shiba Inu, being linked to the performance of Bitcoin and other major altcoins, may see further declines if Bitcoin’s price continues to struggle.

In addition, the broader macroeconomic outlook plays a crucial role in shaping market sentiment. Potential Federal Reserve interest rate hikes or delays in cuts could trigger broader market corrections, affecting cryptocurrencies like Shiba Inu.

The ongoing trade tensions under Trump’s leadership also create uncertainty in the stock market, which could further pressure cryptocurrencies, including Shiba Inu.

SHIB Price Shows Bearish Signals, Risks a 33% Decline

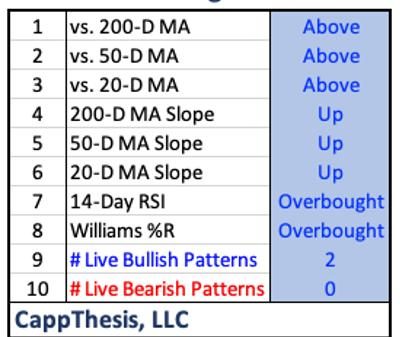

The SHIB price hovered at $0.00001197 on March 13, 2025, experiencing a slight dip of 9%. In the past 24-hours, the meme coins showed some volatility, with support levels at $0.00001150 and resistance near $0.000013. This suggests a potential risk of further decline if the downward pressure persists.

The Moving Average Convergence Divergence indicator shows a bearish crossover, with the MACD line (blue) moving below the signal line (orange). The histogram also reflects negative momentum, which further supports the possibility of continued bearish movement.

If this trend continues, the Shiba Inu price prediction could see a drop toward the $0.000008 mark, representing a potential 33% decline from its current price.

Additionally, the Chaikin Money Flow (CMF) indicator remains positive at 0.03, indicating that there is still some buying pressure in the market.

To sum up, the Shiba Inu price faces significant risks, including its relationship with Dogecoin, competition from new meme coins, Bitcoin’s uncertainty, and macroeconomic challenges. If these risks persist, SHIB’s price could see further declines.

The post Top 5 Risks That Could Impact Shiba Inu Price appeared first on CoinGape.