After a constant downtrend for years, XRP gained bullish momentum in late 2024 and early 2025. However, since then, the Ripple token has been in turmoil. With that, many experts have been questioning the hype around this altcoin as its price performance and other metrics are questionable. One researcher even called it the biggest financial scam due to its low trading volume, but Ripple CTO bets differently. What’s happening? Let’s discuss.

Researcher Claims XRP is the Biggest Scam

Aylo, an alpha please researcher, has questioned the hype around the Ripple token, claiming that this is the biggest scam. In a recent X post, Aylo pointed out the XRPL’s decentralized exchange volume, arguing that it has only $44,000 in volume despite its high demand.

With a snapshot from the DeFiLlama, he questions why such a top crypto with a high market capitalization has such a low volume. His remarks about the ‘biggest scam’ on crypto, which was announced to be part of the U.S. Strategic Crypto Reserve, triggered discussion among the community.

However, things got shorted as Ripple CTO David Schwartz came in support of the altcoin, along with a few other analysts presenting a different picture.

Ripple CTO Discards Researcher’s XRP Allegation

As the allegation led to a major discussion among the community, Ripple’s CTO corrected the researcher. With a comment on Aylo’s post, he clarified that the mentioned data represented only the Automated Market Makers (AMMs) on the XRPL.

Notably, the AMMs account for just a minor portion of any network usage; Aylo’s allegation ended. David Schwartz also clarified that the suggested volume does not reflect the potential and utility of the Ripple token.

I can’t find the exact page you’re looking at, but I bet that’s just looking at AMMs on XRPL, a miniscule fraction of what people use XRP for.

Additionally, Vet, a dUNL validator, supports the Ripple CTO’s claims by presenting the correct volume figures. According to Vet’s stats, the actual 24-hour decentralized exchange volume on the XRPL is nearly $9M, which is not what the researcher claimed.

More importantly, he called it the right opportunity for the market participants to leverage XRPL’s growth in the DeFi ecosystem. He claimed that a low DEX volume is the opportunity due to minimal participation.

How is XRP Performing Today, and What’s Next?

Despite the researcher’s scam allegation on the Ripple token, global investors still see it as a potential opportunity due to better updates from the SEC vs Ripple case, Donald Trump’s crypto reserve formation, and probable ETF launch this year.

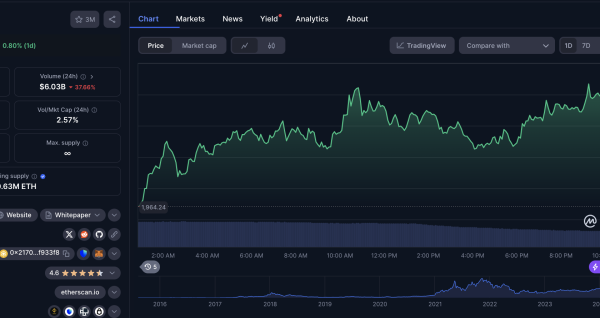

XRP currently trades at $2.40 with a market capitalization of $139.54B, making it the fourth biggest crypto after Bitcoin, Ethereum, and Tether. At present, its performance is significantly down amid the broader market correction. However, significant rallies with a shift in market sentiments are expected.

The post Why a Researcher Called XRP a “Biggest Scam” and Here’s How Ripple CTO Defended It? appeared first on CoinGape.