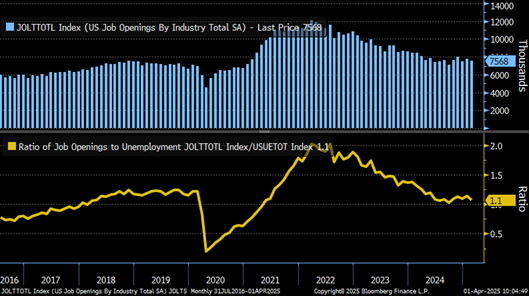

U.S. job openings fell in March to their lowest level since 2020, reinforcing expectations that the Federal Reserve may consider a rate cut later this year.

Job Openings See Lowest Level in Four Years

Ahead of the FOMC meeting in May, data from the U.S. Bureau of Labor Statistics shows job openings dropped by 288,000 in March to 7.192 million. This was below the expected 7.490 million. February’s figure was revised downward to 7.480 million from the initial 7.568 million.

The job openings rate also declined to 4.3% from 4.5% in February. The quits level increased to 3.332 million, with the quits rate rising slightly to 2.1%. Economists often view the quits rate as a measure of worker confidence in the labor market.

Kathy Jones, Chief Fixed Income Strategist at Charles Schwab, stated, “The ratio of job openings to unemployed individuals dropped to 1.0, matching its four-year low.”

Labor Market Cooling but Not Contracting

Layoffs also decreased during March to 1.558 million as compared to the revised 1.780 million in February. The job loss incidence went down to 1.0 % from 1.1%. While employment is declining more slowly, companies are not increasing layoffs, suggesting they aren’t cutting staff aggressively.

This deceleration suggests that Fed Chair Jerome Powell’s decision for a rate cut move may be necessary in case of a deterioration in labor conditions. Moreover, in a press briefing, Treasury Secretary Scott Bessent said the administration is holding talks with several partners and confirmed it plans to use tariff revenue to finance the ITA.

“There is a good chance we will see this in the upcoming tax bill,” he stated.

Some of the changes included repealing taxes on tips, social security income, and overtime pay, and reinstating the tax deductions for interest on automobiles that American manufacturers build. Bessent also stated that these changes could be supported by tariffs that would guarantee stable revenues.

Analysts Raise Odds of Fed Rate Cut in Late 2025

The combination of weak labor market data and soft consumer confidence has led to increased market speculation about a move by Jerome Powell for a Fed rate cut in the coming months. While forecasts show a 91% chance of no rate change in May despite the FOMC meeting, the possibility of cuts later in 2025 rose to 89% according to Polymarket.

Joel Griffith from the Heritage Foundation said, “Slower or even negative growth and higher prices could lead to a shift in Fed policy.”

Ted, a financial analyst, shared a broader outlook tied to potential Federal Reserve rate cuts. He expects “rate cuts and quantitative easing by Q4,” pointing to a supportive economic environment under what he called a “pro-crypto administration.” He cited Donald Trump’s stance on digital assets and Paul Atkins’ appointment as US SEC Chair as policy shifts likely to encourage crypto adoption.

Ted also referenced upcoming approvals of crypto-based ETFs like the XRP ETFs and broader institutional involvement. He said that “global regulatory clarity” may accelerate digital asset growth, particularly if Fed rate cuts begin to ease financial conditions.

The post JOLTS Job Openings Hits 4-Year Low Ahead FOMC Meeting, Strengthens Case For Fed Rate Cut appeared first on CoinGape.