VanEck’s new tokenized Treasury fund “VBILL” is set to launch on Binance (BNB), providing institutional tailwinds. Can this drive BNB’s price to new all-time highs as it rebounds with a rising channel?

VanEck Launches VBILL Fund on Binance Chain

VanEck, an asset management company, announced a tokenized real-world asset (RWA) fund, VBILL, to offer exposure to short-term U.S. Treasury bills. This milestone development is in partnership with Securitize, and the VBILL will operate on Binance Smart Chain, Ethereum, Solana, and Avalanche blockchains.

The launch marks a monumental shift in TradFi towards blockchain technology with the tokenized U.S. Treasuries. Notably, the VBILL accounts for $6.9 billion of the total RWA market. Driving the blockchain narrative, Securitize previously tokenized over $3.9 billion in assets from BlackRock.

The $100,000 minimum investment barrier for the VBILL fund exposure targets High-Net-Worth Individuals (HNI) and institutions. Such individuals could fuel the capital flows to all four blockchains as a real-world use case of BNB Chain boosts its credibility in the blockchain-based capital markets.

Institutional Tailwinds to Ignite New All-Time High

BNB price trades at $648 after a 10% jump last week, forming a bullish candle. Following the 70% crash from $670 to $202 between November 2021 and October 2023, Binance coin remained an underperformer. Since the 2023 low, the altcoin has surged 270% and formed a new all-time high at $794.

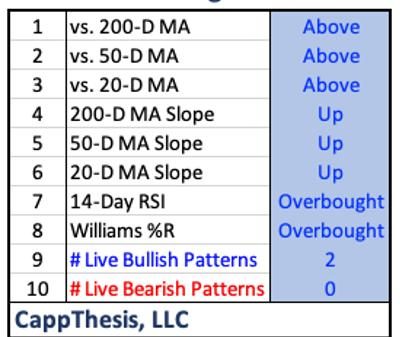

The bullish trend forms a rising channel in the weekly and the previously mentioned bullish candle, suggesting a bounce back. The bull run in BNB’s price trend targets the current all-time high at $793, an upside potential of 21%.

Additionally, the weekly Relative Strength Index (RSI) line rebounds from the halfway point after a steep pullback. The MACD indicator hints at the start of a new positive histogram cycle. Hence, technical indicators support the uptrend continuation thesis within the rising channel, aligning with the Binance coin price prediction of a new all-time high in 2025.

Conversely, a breakdown under the local support trendline will nullify the bullish pattern, risking the $495 retest.

In conclusion, VanEck’s VBILL fund launch on Binance Chain is a pivotal development in institutional interest with a $6.9B tokenized U.S. Treasuries. Fueling investor confidence, a reversal in Binance Coin’s price could support a potential rally toward the $800 level.

The post Binance Chain Project Onboards VanEck’s VBILL – Here’s How It Will Affect BNB Price appeared first on CoinGape.