Ethereum price rose 3.6% on Saturday, reclaiming the $2,220 mark at press time. With ETH price outpacing BTC’s recovery, key trading signals suggest bull traders are capitalizing on ETH’s oversold status from last week’s volatile events.

Ethereum (ETH) retakes $2,200 with recovery motion outpacing BTC

Ethereum (ETH) was among the hardest-hit assets during last week’s crypto market downturn, which was exacerbated by renewed fears over Trump’s trade policy risks overshadowing Bitcoin’s strategic reserve updates. Between March 2 and March 7, ETH price plunged 16%, briefly dipping below the $2,000 mark for the first time in months.

However, ETH rebounded swiftly, surging 3.6% on Saturday, despite a concerning U.S. Non-Farm Payrolls (NFP) report released Friday.

The NFP data showed inflationary pressures persisting due to Trump’s proposed tariff policies, sending shockwaves through the equities and crypto markets. Yet, Ethereum’s resilience signaled a strong internal bullish catalyst at play, positioning ETH for a continued rebound. If this momentum holds, ETH could establish a new support zone above $2,250, priming it for a potential breakout toward the $2,500 range.

ETH Open Interest Surges 3.8% as traders capitalize on oversold status

Ethereum was one of the most oversold assets last week. While BTC and XRP maintained key psychological supports above $80,000 and $2.00, respectively, ETH dropped below $2,000 for the first time since 2023. This deep pullback triggered a wave of strategic buying as bearish sentiment surrounding the U.S. NFP data began to subside on Saturday.

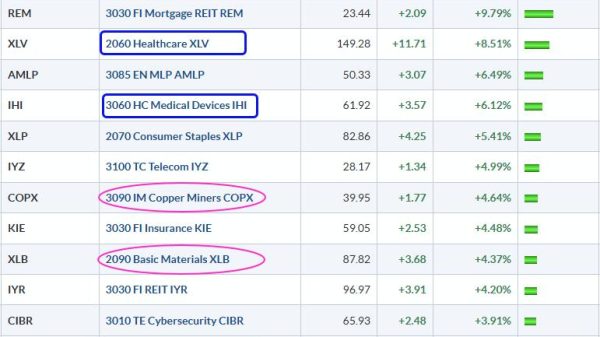

Coinglass derivatives data supports this bullish narrative. Notably, Ethereum’s Open Interest grew 3.8% over the last 24 hours, outpacing its 3.6% price increase. This divergence indicates an influx of leveraged capital backing ETH’s recovery, reinforcing the strength of the ongoing bullish reversal.

Further confirmation comes from ETH’s Long/Short ratio across key exchanges. Binance ETH/USDT’s long-short ratio (accounts) currently stands at 3.4385, while OKX traders maintain a 3.65 long-bias.

Meanwhile, Binance’s top traders hold a notably aggressive stance, with a long-short ratio of 4.2882 in accounts and 2.8742 in positions. This bullish positioning suggests whales and high-frequency traders are accumulating ETH, potentially front-running a breakout above $2,300.

The derivatives market also reveals significant liquidation data. Over the last 24 hours, total rekt positions amounted to $40.94M, with short traders absorbing the bulk of liquidations at $17.28M. The persistent short squeeze dynamic may accelerate ETH’s rally if price action breaches the $2,300 resistance level.

ETH Price Forecast: Falling Wedge Pattern Sets Long-Term Bullish Target at $3,793

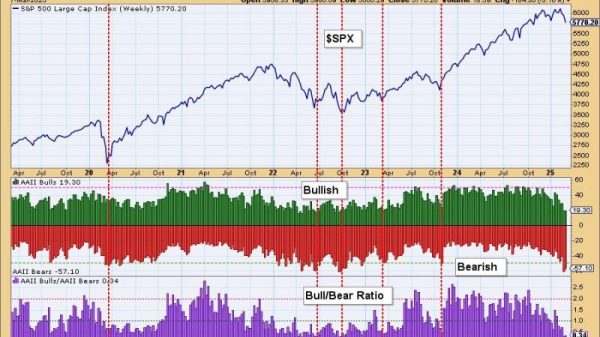

Ethereum price forecast suggests a bullish breakout potential as technical indicators align with strengthening market sentiment. ETH trades at $2,214, posting a 3.39% daily gain while positioning itself for a breakout from the falling wedge formation.

The falling wedge pattern is bullish reversal structure, projects a long-term breakout target by measuring the pattern’s widest range and extending it from the breakout point.

ETH’s recent price compression within the narrowing wedge suggests dwindling bearish momentum, supporting the likelihood of a bullish resolution. A daily close above the wedge resistance at $2,442 would confirm the breakout, setting up Ethereum for a rally toward $3,793.

The Bollinger Bands suggest expanding volatility, with the price testing the midline resistance near $2,442. If Ethereum clears this threshold, momentum could accelerate toward the key psychological level of $3,000, followed by the projected bullish target of $3,793. However, the Bull-Bear Power (BBP) indicator remains deeply negative at -278.62, signaling that bearish pressure has not fully subsided. If selling reemerges near the wedge resistance, ETH could face a short-term retracement toward the $1,965 support zone.

However, failure to sustain above this level may expose ETH to a liquidity sweep, triggering leveraged long liquidations and a potential retest of lower support levels.

The post Ethereum Price to Reach $3,793 in March 2025? Latest Insights from Falling Wedge Pattern and Coinglass Data appeared first on CoinGape.