The crypto market is expected to experience high volatility as the crucial US CPI and PPI data are scheduled for this week. If the inflation rates come in higher than expected, it may trigger a sharp downturn in the crypto market, potentially sending Bitcoin’s price to significant lows.

Notably, the timing of these reports is crucial, as they precede the Federal Reserve’s meeting on March 18-19, influencing the central bank’s decision on interest rates. Let’s examine how the upcoming reports will shape the Fed’s decision and the potential fallout for the crypto market.

Crypto Market Braces for Impact: US CPI Report Looms

Significantly, the US CPI and PPI reports are slated for release this week, with the CPI report arriving on March 12 and the PPI report following on March 13. This has sparked anxiety among crypto traders and enthusiasts as these macroeconomic indicators could possibly evoke high market volatility.

According to a Reuters poll, the US CPI for February is expected to have climbed 0.3%. Wall Street expects that the CPI data will come at 2.9%. If the data showcases a surge in the inflation rate, a crypto market downfall could follow. Bryant VanCronkhite, the senior portfolio manager at Allspring Global Investments, stated,

A hot CPI print will likely scare the market. The market still wants the Fed to come to the rescue… Until inflation and inflation expectations come down, the Fed is handcuffed.

How Will CPI & PPI Data Impact Fed Rate Cut?

Interestingly, the Federal Reserve’s meeting comes following the US CPI and PPI data release. These reports could have a significant impact on the central bank’s decision on the interest rate as well as the crypto market.

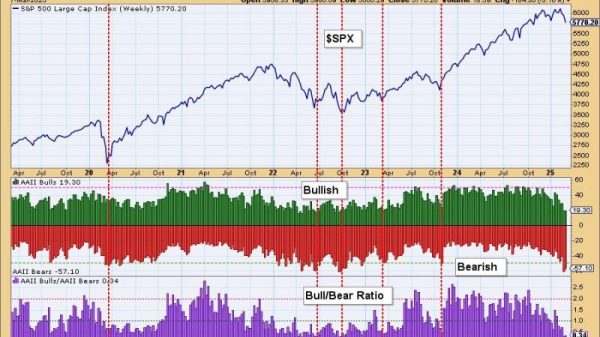

The Fed is likely to maintain its benchmark interest rate at 4.25%-4.5% during the upcoming meeting, according to CME FedWatchtool Data. But, market expectations suggest further easing is on the horizon, with around 70 basis points of cuts anticipated by December, as indicated by Fed funds futures data from LSEG. If the PPI and CPI reports reveal a hot inflation rate, the Fed may opt to keep interest rates unchanged or even consider a hike.

Recently, Fed Chair Jerome Powell has expressed a hawkish stance on interest rate cuts. Powell stated,

Our policy stance is now less restrictive than it had been, and the economy remains strong. We do not need to be in a hurry to adjust our policy stance.

Will Bitcoin Price Explode or Correct?

In February, following the US CPI data release, the crypto market experienced a severe selloff. This led to the market’s massive fall of 3.3% to $3.1 trillion. As the CPI data marked a higher-than-expected inflation rate, Bitcoin plummeted to $94,000, down 3%.

Considering this, the crypto market is expected to face another downturn next week. In addition, Bitcoin ETFs marked significant outflows, recording a total of $409 million. 21Shares’ ARKB experienced the largest outflow of $160 million, followed by Fidelity’s FBTC with $154.9 million outflows.

However, analyst Crypto Caesar identifies the bearish sentiment as the last bear trap before entering the bull market.

Meanwhile, analyst Ali Martinez revealed that 63.13% of traders on Binance Futures have opened long positions on Bitcoin. This implies that the traders are optimistic about the Bitcoin price’s bullish ascendance in the future.

The post Crypto Market Awaits US CPI; What’s Next For Bitcoin Price? appeared first on CoinGape.