Cryptocurrency prices were largely flat ahead of the upcoming US Consumer Price Index (CPI) data. Bitcoin (BTC) price was stuck at $82,400, while Ethereum (ETH) and Ripple (XRP) were trading at $1,885 and $2.20, respectively. This article provides a forecast for the BTC, ETH, and XRP ahead of the CPI and as Japan 30-year bonds surged to the highest point since 2008.

BTC, ETH, XRP Analysis as Japan 30Y Yields Surges Ahead of US CPI

The Japanese bond market continued its freefall this week. Japan’s 30-year bond yield soared to 2.62%, a big increase from 0.227% in 2020. Similarly, the ten-year yields jumped to 1.58% from the January low of about 1%.

The ongoing bond yield surge is primarily because the Bank of Japan (BoJ) has embraced a highly hawkish tone this year. It has hiked interest rates by 0.25% and hinted that more were coming as inflation remains elevated.

The BoJ is hiking rates as concerns about the global economy remain as the Trump tariffs continue. Also, it is doing that as other central banks, including the Federal Reserve and the European Central Bank (ECB), slash rates.

The BoJ’s actions impact all assets, including BTC, ETH, and XRP. That’s because the rising bond yields is helping to unwind a carry trade that existed for years. A carry trade is a situation where investors borrow cheaply in Japan and invest in high-yielding assets, including Bitcoin. As the yields rise, many investors are now unwinding these bets.

BTC, ETH, and XRP will next react to the US CPI data. Economists expect the data to show that inflation softened slightly in February, making the case for a future Fed cut now that US bond yields are falling. However, these inflation numbers may not move the needle a lot since they will not include Trump’s tariffs.

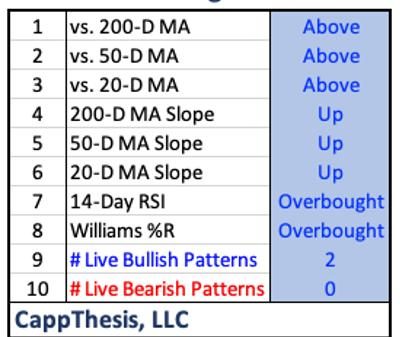

BTC Technical Analysis

Bitcoin price bottomed at $76,500 on Tuesday and then bounced back to $84,000 as traders focused on US-Canada relations. It remains below the 38.2% retracement level. The 50-day and 200-day Weighted Moving Averages (WMA) have crossed each other, forming a death cross. A death cross is one of the riskiest patterns in the market.

Therefore, the BTC price will likely resume the downtrend and possibly retest the support at $76,500. Ultimately, the coin will likely do a break-and-retest by moving back to the key support at $72,500, the highest swing in March of last year and the 50% retracement. It will then bounce back, possibly after the Lunar Eclipse happens on Friday.

ETH Price Technical Analysis

The weekly chart shows that the ETH price formed a triple-top pattern at $4,035. It has now crashed below the neckline at $2,153, validating the bearish view.

Ethereum price has also dropped below the 61.8% retracement level, which is known as the golden ratio. That’s because most reversals happen at that level. Therefore, the path of the least resistance for ETH price is bearish, with the next target being at $1,545, the lowest swing in October 2023. A move above the key resistance at $2,200 will invalidate the bearish view.

XRP Price Technical Analysis

The XRP price bottomed at the crucial support level at $1.9615. This was an important level since it was the neckline of the head and shoulders pattern. The ongoing rebound is a sign that investors are fighting back to prevent a drop below that level.

A crash below $1.9615 would likely lead to panic selling and risk the coin falling to $1. The H&S pattern is still a risk, which will become invalidated if it rises above the right shoulder at $3.

Summary on Crypto Market Price Action Ahead of US CPI

The upcoming US CPI data will likely have a mild impact on the crypto market because it will not include the recent tariffs. However, the actions by the Bank of Japan, which meets next week, may have a significant impact on coins like BTC, ETH, and XRP because of the carry trade factor.

The post BTC, ETH, XRP Price Prediction as Japan 30Y Bond Hits 2008 High Ahead of CPI appeared first on CoinGape.