ARK Invest under the leadership of Cathie Woods has added more Bitcoin holdings through purchasing 997 BTC which is reportedly worth $80 million. The purchase was executed through two transactions on March 13, 2025, via the crypto exchange Coinbase. This is in line with the firm’s ongoing plan of holding a major position in digital assets as it expresses confidence in Bitcoin.

Ark Invest Acquires 997 BTC Through Coinbase

According to data from Arkham Intelligence, Ark Invest acquired 997 BTC worth $80 million from Coinbase on March 13, 2025. The transaction was split into two parts: the first purchase included 498 BTC, while the second, completed four hours later, added 499 BTC.

The acquisition occurs at a time when Ark Invest is seeking to increase its Bet on Bitcoin. Currently, institutional investors remain very active holders of cryptocurrencies and a large number are invested in Bitcoin ETFs. The most recent acquisition shows that the firm is willing to remain in the digital asset sector regardless of the price swings.

However, apart from this latest BTC purchase, Ark Investment has sold roughly $9 million of its BTC ETFs invested in the company. This sentiment is in line with other institutions selling, as $1.1 billion exited spot Bitcoin ETF. The reason for this can be attributed to a declining performance of the US stock market, inflation concerns, and uncertainties in trade policies.

Ark Invest Rebalances Portfolio

In addition to acquiring Bitcoin, Ark Invest recently increased its Coinbase (COIN) stock holdings. The firm purchased 64,358 shares of Coinbase, valued at approximately $11.53 million. This marks its largest investment in Coinbase stock since August 2024.

Unlike previous portfolio adjustments, Ark Invest did not sell its spot Bitcoin ETF holdings. The firm’s decision to retain Bitcoin while expanding its Coinbase stock holdings suggests a strategic shift in its investment approach. Analysts view this move as part of Ark Invest’s long-term strategy in the digital asset sector.

Bitcoin Price Action Amid Institutional Interest

In recent weeks, Bitcoin price shifted due to institutional buying and selling together with other factors in the crypto market. Ironically, BTC has remained an essential commodity for long-term investors who keep amassing.

More so, Cathie Wood remains a supporter of Bitcoin. Cathie previously forecasted an increase in BTC price to $1 million per coin by 2030.

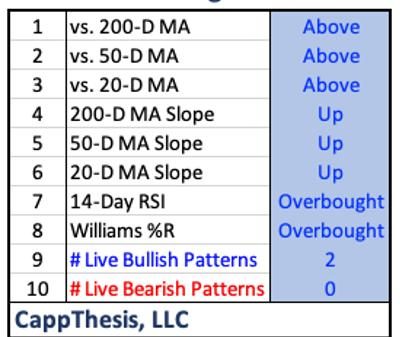

Nevertheless, Bitcoin’s strength has diminished due to the trading war impact, which makes the asset still bearish. Bitcoin price traded in the $79,000 range before rising back to the $81,000 mark, but faced resistance at the $83,700 level. In case, the selling pressure continues, BTC price may further decline towards the $75,000 Support level.

The post Cathie Wood’s Ark Invest Expands Bitcoin Holdings With $80M Buy appeared first on CoinGape.