Most crypto market tokens experience continuing price declines while showing few signs of recovery. The Federal Reserve head Jerome Powell is under intense market observation regarding his upcoming decisions. The market may experience additional downward pressure when Powell fails to indicate interest rate reductions. In this scenario, certain crypto to sell to avoid losses.

Crypto to Sell If Powell Doesn’t Indicate Rate Cuts

As the Federal Reserve concludes its policy meeting on March 19 today, it is expected to keep interest rates unchanged. However, it may signal potential rate cuts later in the year through the quarterly summary of economic projections. If Fed Chair Jerome Powell does not indicate such cuts, investors might consider this Crypto to avoid BNB, PI, LEO, and SHIB, which could face pressure.

PI Network (PI)

The Pi Network token has experienced a sharp price decline, with its value falling over 5% over the past day. As of writing the PI price hovered at $1.16. A key factor contributing to this volatility is the approaching Pi token unlock event. Roughly 129 million Pi tokens, worth an estimated $175 million, are set to be unlocked soon.

Additionally, the possibility of a Pi Network Binance listing remains unclear, further adding to the uncertainty surrounding the coin’s future. The PI price has dipped over 30% over the past, now trading near $1.14. What’s going on, and is Pi at risk of falling below $1?

Binance (BNB)

Binance (BNB) price has recently dropped below the critical support level of $650, seeing a 3% decrease. While other major cryptocurrencies show slight growth, BNB faces downward pressure. If the bearish trend continues, the price could fall to $600.

The crypto market may view BNB as suitable crypto to sell based on Jerome Powell’s statements about interest rate policies. Market conditions together with statements made by Powell regarding interest rates will determine BNB’s future price performance. The BNB price is trading $617, struggling to recover.

UNUS SED LEO (LEO)

UNUS SED LEO (LEO) token reached an all-time high in early March 2025, standing out in a generally bearish crypto market. However, since then, its price has faced a slight decline. If LEO falls below the crucial support level of $9.50, it could drop further to $9.20.

In a highly bearish scenario, the token’s value may dip below the $9 threshold. Investors should consider LEO among the Crypto to Sell if the Federal Reserve’s Jerome Powell does not hint at any rate cuts.

Shiba Inu (SHIB)

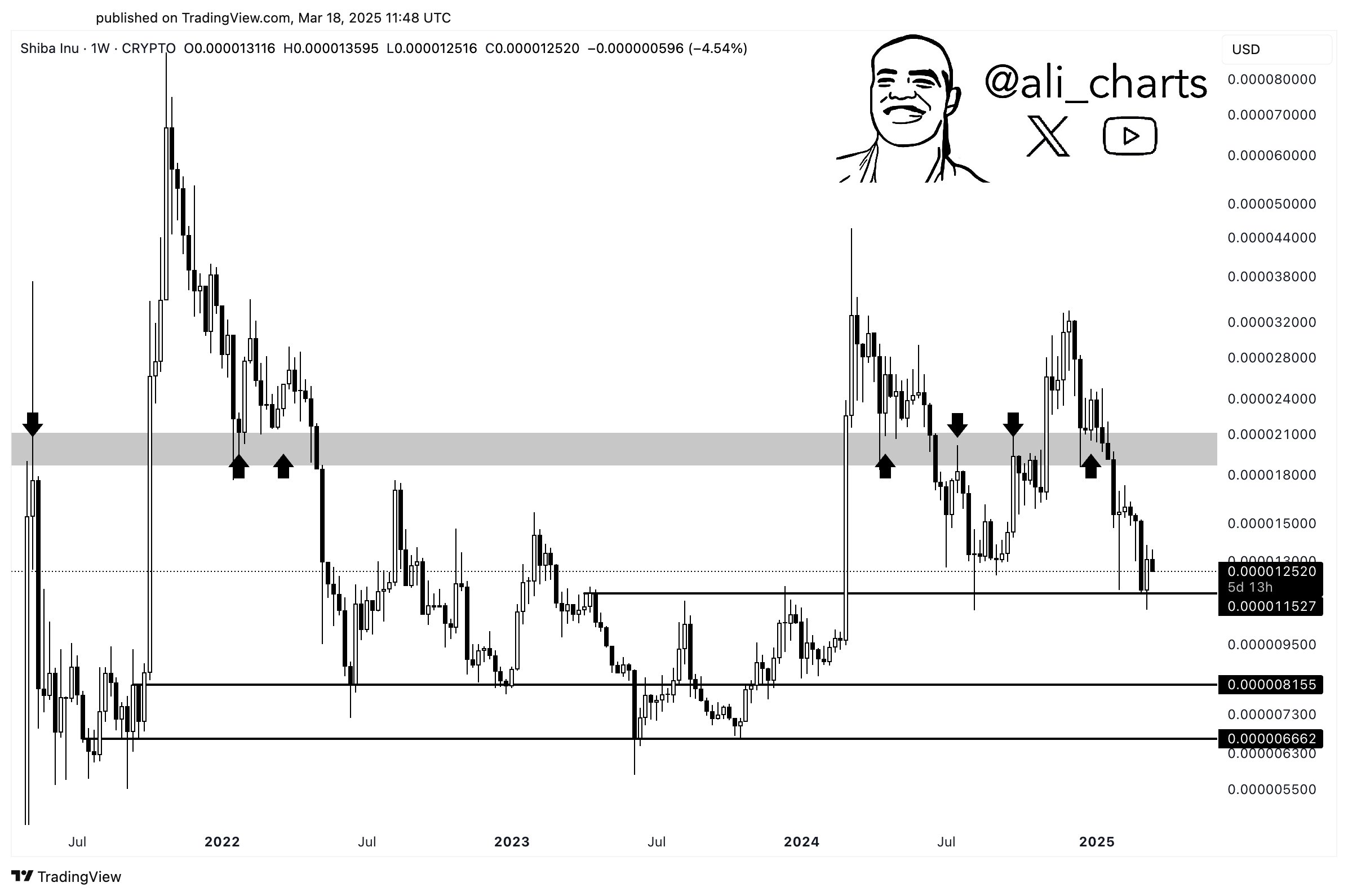

Shiba Inu price has remained above the support level of $0.000012, but recovery efforts are facing strong resistance. The token achieved high values in January before it started declining and lost its ability to recover its previous gains.

Crypto analyst Ali tweeted Key to watch for the Shiba Inu Price with support levels of $0.0000115 and $0.00000815.

The SHIB burn rate demonstrates a significant decrease because it lowered by 41% during the previous 24 hours. The quantity of SHIB tokens burned during the past day amounted to 9,681,341 which represents a clear reduction from previous times.

Recently the bearish market attitude is spread to the rest of the meme coin sector which deepens the negative sentiment in crypto markets.

The Shiba Inu cryptocurrency dropped 20% worth during the recent month which positions it among cryptocurrencies that should be avoided for stable investment.

Conclusion

To sum up, If Powell’s message does not indicate rate cuts, it could lead to more crypto market declines. For those holding struggling assets, it’s crucial to consider crypto to sell. Stay cautious and make informed decisions based on upcoming Federal Reserve announcements.

The post 4 Crypto to Sell If Fed’s Jerome Powell Does Not Hint Rate Cuts appeared first on CoinGape.